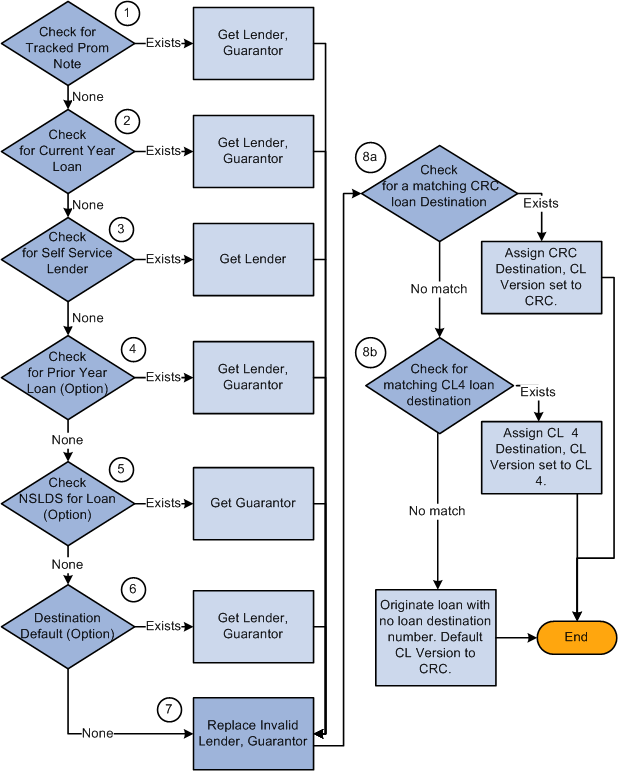

If a recipient with an agreement specifying two years to undertake activities determines that it has had substantial disbursement from the fund within the 180 days although it had not met this 25 percent threshold, the justification for the recipient's determination shall be included in the program file. The following diagram shows how the application helps bank agents.

#LOAN DRAWDOWN PROCESS PLUS#

(Where CDBG funds are used as a guarantee, the funds that must be substantially disbursed are the guaranteed funds.) For a recipient with an agreement specifying two years to undertake activities, the disbursement of 25 percent of the fund (deposit plus any interest earned) within 180 days will be regarded as meeting this requirement. A drawdown refers to each amount that the borrower accesses from the line of credit facility. In addition, substantial disbursements from the fund must occur within 180 days of the receipt of the deposit. Access via Request Main Menu, then select MRTL Loan Draw Down. Use of the deposited funds for rehabilitation financing assistance must start (e.g., first loan must be made, subsidized or guaranteed) within 45 days of the deposit. The terms drawdown and disbursement have multiple meanings in the finance world, though they are different things altogether. Log in to DBS digibank with your User ID and PIN and complete the Authentication Process. (4 ) Time limit on use of deposited funds.

0 kommentar(er)

0 kommentar(er)